Personal Liability Insurance in Germany - Why You Need It

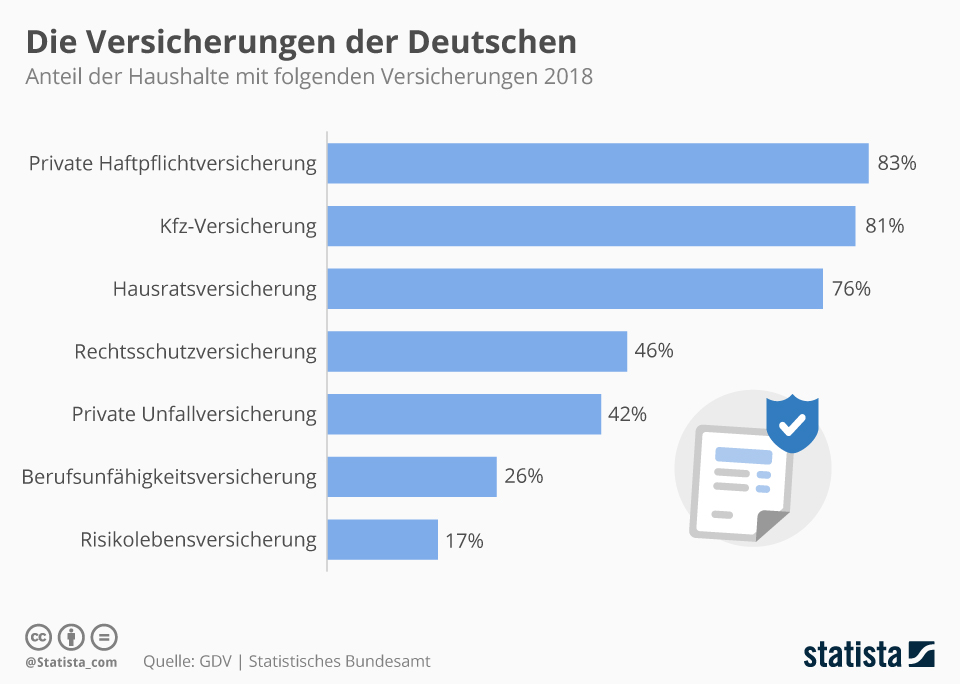

Accidents happen – and it is impossible to prevent them. But while honest little slip-ups might be harmless in most countries, in Germany accidents can also land you in deep financial trouble. In fact, you are required by law to pay for the damages to do to other people and their property. It is no wonder then that personal liability insurance in Germany (Haftpflichtversicherung) is used by approximately 83% of the population to protect you (and your pocketbook) from these unforeseen mishaps.

We’ve compiled everything you need to know about German private liability insurance – what it is, why you need it, what it covers, what it doesn’t cover, and what are the best plans available today.

DISCLOSURE: This post contains affiliate links. This means that, at no cost to you, the Black Forest Family may earn a commission if you click through to make a purchase. To learn more, please read our disclosure for more information.

Best Liability Insurance in Germany

If you’re short on time, we’ve summarized the top liability insurance options in Germany here:

Getsafe

The lowest cost of the three, starting at €2.94/month. If you're looking for liability insurance in Germany that's easy to use and offers unlimited coverage, consider GetSafe. Their app and customer support are available in English, and you can cancel anytime. The coverage is exceptionally clear and easy to navigate.

100% English 24/7 support, 1 simple plan with add-ons.

This is actually the insurance provider we personally use here in Germany.

Feather

Starting at €4.94/month, Feather provides 100% English support and a very comprehensive plan. Although it is the highest starting cost of the 3 recommendations we have, they have arguably the best standard plan.

Luko

Starting at just €4.99 per month, Luko is a reputable full English speaking insurance provider who provides two different tiers of insurance to help cover exactly what you need.

This coverage includes bodily injury, property damage, and financial loss caused to a third party. Luko's private liability insurance covers you worldwide and includes legal defense costs. The coverage limit starts at €10 million and can go up to €50 million, depending on your needs. You can customize your policy and add additional coverage for specific activities, such as water sports or outdoor activities. Luko also offers a 24/7 claims service, making it easy to file a claim at any time.

Luko also offers a 15euro discount for new signups. Use the code 15RABATT when you sign up!

Click here to get a quote with Getsafe in minutes.

Click here to get a quote with Feather in minutes.

Click here to get a quote with Luko in minutes.

What is German Personal Liability Insurance (Haftpflichtversicherung)?

Anyone who has spent time living in Germany would tell you that private liability insurance is the most important insurance you can buy (besides the mandatory health insurance). According to Statista, 83% of people living in Germany have liability insurance.

Mehr Infografiken finden Sie bei Statista

Mehr Infografiken finden Sie bei Statista

Haftpflichtversicherung – the long and difficult to pronounce word is a liability insurance that Germany recommends, but does not require, for everyone. It’s a type of insurance that will cover the costs incurred with Sachschäden (property damage), Vermögensschäden (financial loss), and Personenschäden (personal injury).

Much like car insurance, dog liability insurance, legal insurance and dental insurance, it is HIGHLY recommended to sign up to protect you in case of a future problem.

Why You Need Personal Liability Insurance In Germany

Personal liability insurance is like health insurance (Krankenversicherung), but for day-to-day personal/property damage protection.

For example, we have health insurance to shield us from unforeseen health problems and bodily accidents. But what about unforeseen property damage and accidents that you (or your children) do to other people?

If we need insurance to protect us from costly medical bills, shouldn’t we also have insurance to protect our pocket books from costly damage we accidentally do to others? In Germany, definitely.

Unsurprisingly, it is required by law in Germany that you pay for damage made to property or to another person. From your child accidentally throwing a ball through a neighbor’s window to your grill setting a neighbor’s garage on fire – it doesn’t take much imagination to understand how everyday accidents could quickly lead to personal bankruptcy.

As a matter of fact, some German universities and scholarships require that you have private liability insurance. International students may not be allowed to enroll in school without proof of this.

Let’s take a look at some examples:

German Liability Insurance Claim Example #1:

You are living in Germany and lose the key to your rented apartment, which is also a shared key to access the common areas of the building.

(First of all, NEVER LOSE YOUR GERMAN APARTMENT KEY! This is the holy grail of German rules. For now, we will skip over the stern talking to by your landlord, which by itself is nearly as bad as the costs that will inevitably come with this simple mistake.)

If you lose your apartment key in Germany, it’s more complicated than going down to a locksmith to get a new one. Because your lost key will put your entire building at risk, you may be required to pay for replacing every shared lock on the building and providing new keys to all of your neighbors. This can lead to thousands of €’s, especially for buildings with high levels of security or technology.

Have private liability insurance in Germany? Good. You’re covered from the costs here. ….now if only it would cover the uncomfortable conversations with your landlord.

German Liability Insurance Claim Example #2:

A bystander asks you to use their camera and take a picture of them and their family while visiting Germany. Being a nice and thoughtful person, you are happy to capture their once in a lifetime glamor shot. Unfortunately, your thoughtfulness might come at the cost of clumsiness.

After taking the award-winning family photograph, you drop the camera when trying to hand it back to the owner. This is your fault, and you are responsible for the costs of the camera.

Do you have German private liability insurance? Good. You’re safe and the replacement costs are covered! If not, you will be required (by law) to pay for the replacement cost out of pocket.

German Liability Insurance Claim Example #3:

You’re on a trail run in the Black Forest and look down at your phone for a few seconds to read a message. During this time someone walks in front of you off of a converging trail and you accidentally hit them and they fall and break an ankle.

Without German liability insurance you will be required to pay for the medical costs related to this accident. If you have it, you’re covered. In this example, it is also recommended to have legal insurance in case the situation becomes worse.

What Is Typically Covered with German Personal Liability Insurance

Personal liability insurance in Germany can cover a great deal of foreseeable mishaps. Depending on which company you go with, there are even add-ons you can include to better fit your lifestyle.

Here is what is typically included:

Coverage for your spouse and children

Key replacement costs to a rental property

Damage to personal property

Damages to rented property

Personal accidents

Damages caused while riding a bicycle

Against uninsured 3rd parties

Sporting accidents

Legal costs if sued for damages

Optional Add-ons:

Accident deductible coverage of borrowed or rented vehicles

Incorrect refuelling of a borrowed or rented vehicle

Damage caused by free assistance

Replacement value of personal items

What Is Typically Not Covered With German Personal Liability Insurance

Personal liability insurance in Germany is a thorough blanket of coverage for most scenarios; however, there are a few which are excluded simply because they have their own dedicated insurance policy.

That’s right, you may feel like there are an infinite number of different insurance plans in Germany to purchase, like legal insurance.

Here is what is typically excluded:

Liability while driving, you’re covered here with auto insurance (Kfz-Haftpflichtversicherung)

Penalties and fines

Injuries due to extreme sports (this can sometimes be an add-on)

Damage to your house as a homeowner, you need homeowners insurance (Hausratsversicherung) and building insurance (Gebäudeversicherung). Keep in mind these will only cover damage from external sources (not damage you have done)

Damaged caused intentionally

Damage/injury from hunting

Damage/injury due to unauthorized possession of a weapon

Injury due to a dog. You will need dog liability insurance (Tierhalterhaftpflichtversicherung)

Accidentally broke your friends phone? Liability insurance will cover you.

What Happens If You Don’t Have Personal Liability Insurance In Germany

If you are in Germany and do not have private liability insurance, you will be legally obligated to pay out of pocket for damages to personal property or injury to a person.

This can be thought of along the same lines as health insurance (Krankenversicherung). If you become sick and require an emergency room visit, your health insurance has you covered. Without this health insurance, you’re liable for all costs, which can be significant.

For expats living in Germany, there are private liability insurance plans which are available in English, have an app for claims, and can be completed in just a few minutes for just over €2 per month. It is a no brainer to take this protection and protect yourself from debilitating costs due to accidents.

What To Consider When Purchasing German Personal Liability Insurance

Not all plans are created or managed equally. Take into consideration what you and your family needs with your lifestyle.

Are you an expat living in Germany? You probably have more questions and needs than the average German citizen.

Here is what you can consider when shopping for German liability insurance:

English Contract:

For expats living in Germany who are not native German speakers, most likely you may be looking for options that are 100% English. Even with a good understanding of the German language, be cautious with fully understanding the fine print in your legal contract. Customer support, contracts, and claims can be available in English. Good news, these exist!

English Website & App Option:

Google Translate can automatically convert most websites relatively easily, but it’s not guaranteed. Putting the responsibility of the English translations on the company will prevent unknown mistakes.

English Speaking Customer Support:

Trying to speak German when it comes to legal terms or explaining the all-important details of an accident can make you sweat with anxiety. Take the stress away knowing that the accident you’re dealing with can be handled without any additional stress.

No Paperwork:

Germans are known to love paperwork, rules, and snail mail. Trying to navigate written forms and mailing them around the country can be stressful and time consuming. We recommend looking for companies who are capable of handling claims and contracts through smartphone apps.

Family Included:

Living in Germany as an expat with a family? Make sure your plan can extend to your spouse and children.

Customized Add-ons:

Custom policies with add-ons to suit your lifestyle are available with some plans.

No Contact Duration:

Contract durations in Germany commonly require 3 months to a year notice to cancel. If you’re unsure of your future of living in Germany as an expat, consider a plan which allows immediate cancellation.

International Coverage:

Travel internationally? Some of these plans provide worldwide coverage!

Coverage Amount:

Have a high coverage >€25 million. Damage costs to commercial property or public transit can be extraordinary.

Monthly Cost:

Many of the policies available are competitive with each other, just be sure what you sign up for is a realistic cost for the coverage you personally need.

How Much Does Personal Liability Insurance Cost In Germany?

Personal liability insurance in Germany can cost as little as €2.05 a month. Including a spouse and children plus add-ons can double or triple this amount. It’s really a small amount of money to help you sleep well at night knowing you won’t go bankrupt by accidentally scratching your boss’s Ferrari with your bicycle handlebar.

What Are the Best Personal Liability Insurance Plans In Germany

The top 3 personal liability insurance in Germany are Getsafe, Feather and Luko. We’ve landed on these 3 because of extensive English-speaking options, clear contracts, and extraordinarily easy to file claims. We recommend that you check these plans out and get signed up with one of them immediately. A quote requires a very short questionnaire and takes under 3 minutes.

Click here to get a quote with Getsafe in minutes.

Click here to get a quote with Feather in minutes.

Click here to get a quote with Luko in minutes.

Source: Feather

Feather

Feather is a popular English speaking insurance in Germany which offers a range of different coverage. For liability insurance, Feather is arguably the most comprehensive, but it does come at the highest price of €4.94/month.

Pros:

High coverage of €50m

English everything

No deductible

Easy add-on for family members

Well-reviewed customer service

No fixed duration

Cancel any time

Cons:

€4.94/month, the most expensive of the 3

Click here to get a quote with Feather in just minutes!

Source: Getsafe

GETSAFE

Getsafe is a popular English speaking insurance in Germany which offers a range of different coverage. Getsafe has one of the most clear and concise packages available with a very high coverage and low cost of just €2.94 per month.

Pros:

€2.94/month basic rate

High coverage of €50m

No deductible option

English everything except contract

No fixed duration

Drone liability as an add-on

Highly rated on Google Play & App Store

Cons:

No English contract available

App must be used for all actions

Source: Luko.

Luko

Luko, a digital insurance provider based in Berlin, Germany, offers liability insurance starting at €4.999 per month. Luko is overseen by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and member of GDV (Gesamtverband der Deutschen Versicherungswirtschaft e.V.)

Luko also offers a €15 discount for new signups. Use the code 15RABATT when you sign up!

Pros:

English speaking and completely digital

Coverage from €10 to 50 million

Comprehensive coverage: Luko's private liability insurance offers coverage for bodily injury, property damage, and financial loss caused to a third party.

Worldwide coverage: The policy covers you anywhere in the world, which can be beneficial if you travel frequently.

Customizable policy: You can tailor your policy to your needs and add additional coverage for specific activities, such as water sports or outdoor activities.

Legal defense costs included: The policy includes coverage for legal defense costs, which can be significant in the event of a liability claim.

24/7 claims service: Luko offers a 24/7 claims service, making it easy to file a claim at any time.

Cons:

Cost: The cost of the policy may be a concern for some people, especially if they are on a tight budget.

It only takes a few minutes to get covered, be sure to sign up for German private liability insurance before closing out of this page. No one should go one day without this type of insurance while living or working in Germany.

Click here to get a quote with Getsafe in minutes.

Click here to get a quote with Feather in minutes.

Click here to get a quote with Luko in minutes.

Final Comments About Liability Insurance

At just under €3 per month and extensive and high coverage, it is a no brainer to sign up and be protected in your daily life. It’s no surprise why 83% of Germans have also signed up.